This is an old revision of the document!

Table of Contents

Stock System

Stocks are companies that allow you to buy individual shares of the company. Shares are partial ownership of the company. This is useful in many aspects of the game, as it shows ownership and changes the relationship between your company and others.

The Stock portion of the Finacial Room page gives you details about the individual functions of the Stock system. And the Stock Reports page lets you know what individual variables mean. This chapter will focus on the general concept of buying and selling shares, IPOs, dilution, and splits. It will also cover adjusting dividend rates and the take-over process.

Overview

The price of a share change based on what people are willing to pay for it. When companies are doing poorly, the share price generally goes down. And when the company is doing well, the price of a share will go up.

In the game, it is no different. When a company's revenues increase and EPS increases, the share prices will go up. Likewise, if revenues and/or EPS decrease, the share price will go down. External factors, such as market conditions, also play a role in the share price.

The game also gives a minimum market cap value to the stock based on the equity they own. Rarely will the market cap of a company drop below this value.

Companies will also make financial decisions based on the health of their company. For example, it is difficult to acquire a company that is booming. Likewise, a company that is doing poorly will be more willing to be bought out. Companies will issue more shares when they need the money, or their stock is overpriced. Companies will buy other company shares or increase dividends when they are doing well.

Stock Window

The default panel of the Broker window gives you a lot of information you need to know about a company. You can find more information in the Stock Report.

Starting at the variables on the left side of the panel (#1)

- Price ⇒ This is the price of a single share of the company and the percentage change since last month.

- Holdings ⇒ This is the number of shares you own and the percentage of the company that is.

- Shares Outstanding ⇒ This value is the number of shares currently available for purchase.

- Quarter Revenues ⇒ This is the revenues numbers over the latest complete quarter.

- EPS ⇒ This stands for Earnings Per Share. This value is generated from the company's profits divided by the total number of shares issued.

- Dividends ⇒ Dividends are quarterly payments per share made for each share everyone owns.

- Total Shares Issued ⇒ This is the total number of shares issued by the company. If you owned all these shares, you'd own 100% of the company.

The checkbox on the right side of the panel (#2) is the shares notification system. When enabled, this checkbox will send you a memo if any shares become available for purchase.

At the bottom of the variables is the shareholder morale (#3). This variable appears only if the company you run is selected. The shareholder morale shows how your shareholders and board of directors view your leadership. If their morale becomes poor, they can force actions at your company without your input. And if you have the “Can Be Fired” setting enabled, they can fire you, resulting in a game over. To make shareholders happy, you need to grow the stock price by having good results. Another way to make them happy is to increase your dividend payouts.

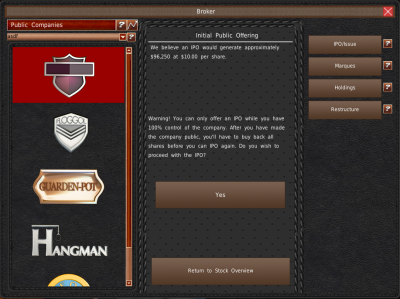

When to IPO

IPO stands for Initial Public Offering. When you IPO, you break your company into small pieces called “shares,” and then you sell those shares to the general public. Each share is fractional ownership of the company. You can only do an IPO if you own 100% of the shares. When you start the company, you own all of the shares. And once you sell shares, it is difficult to buy back all 100% again.

Therefore, you typically only get one chance to IPO. So there are some things you should consider before going public.

Pro

The main purpose of an IPO is to raise money. So the first thing you should ask yourself is, “Do you need a large amount of money now?” If that answer is yes, do you have other ways of raising it? Such as a bond? Would the debt burden of a bond be too much for your company to handle? Yes? Then IPO is the way to go.

You also must look at the situation your company is in. No one will want to invest in a company that is about to go bankrupt. So if you're going to IPO (or borrow money), you should do that BEFORE your company gets in a desperate situation. For example, if you have a bond about to mature that you can't afford, an IPO might be a good way to pay off that debt. The rest of the funds you can use to expand your business.

Finally, you must consider the broader market. If the general market is booming, that's a great time to IPO. But if the economy is in a recession or a depression, it's not the best time to launch an IPO.

Cons

In general, the longer you wait to IPO, the more your IPO will be worth. A company with six factories, in general, is worth more than a company with one. By IPO'ing too early, you'll be leaving money on the table.

Also, when your company is public, other companies can buy part of your company. And shareholders can demand more out of your company, such as dividends. Any subsidiaries you create will also be partially owned by your shareholders based on your share structure. Finally, it's very difficult to undo an IPO. You'll have to purchase all of the remaining shares, which can be difficult and expensive to do if your company is successful.

Conclusion

You should put off IPO'ing until you need the money. The longer you can wait, the more valuable the IPO will be, so long as the company is growing and healthy. If it looks like your company will be unhealthy soon, it is better to launch an IPO now than to wait because an IPO won't be successful if you're nearly bankrupt.

Issues, Splits, and Selling Shares

Selling More Shares

When you IPO, only 25% of your shares are sold to the public. You retain ownership of the other 75% of the company. At any time, you can sell these shares and raise more capital for the operation of your company. Selling these shares works just like selling any other shares in the game.

Issuing Shares

While you typically can only IPO once, you can occasionally issue shares more shares. When you issue more shares, you create new shares. You can then sell those shares if you choose so. When you create new shares, the value of your current shares will go down. Remember, shares are fractional ownership of a company, so if you created more shares, that factional ownership per share would decrease. Shareholders do not like it when you do this action.

To put it into numbers, let's say there are 100 shares of a company. And you own 10. That's 10% of the company. If the company issued 100 more shares, the total number of shares is 200. You still own 10 shares, but now that's only 5% of the company.

When can you issue shares? You can only issue more shares if you own 50% of the company, and it's been more than 6 years since you last issued shares or IPO'd. There is a chance that issuing shares will cause a lawsuit. The chance of a lawsuit decreases every year since the last Issue or IPO.

If you meet the criteria to issue shares, the “Issue More Shares” button (#1) will appear in the center of the panel.

Splits

When a share price reaches too high or too low, a split will occur. A share split multiplies or divides the number of shares and does the opposite to the share price. The same split applies to the shares of the company you own. When a split occurs, there is no change in the market cap (value of the company), nor the value of your stocks, or the percentage of the company you own. A split only changes the share count and the price.

A 2:1 Split (#2) will double the share count but double reduce the share price in half. And a 1:2 Split (#3), also known as a reverse split, will reduce the share count in half but double the price per share.

The game will automatically do 1:2 Splits if your share price falls below $1. And the game will automatically do a 2:1 split if your share price goes over an amount based on the year or the yearly EPS goes over a year-specific value.

The limit for 2:1 share price splits is $30 + (Year-1899 × 2). And the limit for EPS is 4+((Year-1899)/3).

Stock Transactions

One of the fundamental things you do in the Broker window is trade shares. We cover how to purchase and sell shares on the GUI page.

But how do you know what company you should buy? And when should you sell?

What to Buy

So how do you know what is a good investment in the game? Stock prices grow based on revenue and EPS growth. Dividend payouts and the broader movement of the stock market also help.

If you're purchasing shares to make money, you should look at the stock report for growth. You're looking for share price growth, revenue growth, and most importantly, EPS growth.

When a company is growing, the share price will typically follow.

But also that means other companies will purchase shares as well. And they will not be willing to sell them.

You should also look at the broader economy. Does the newspaper mention recessions or depressions? What about other companies? Are their shares growing or declining in price?

If you're looking to buy shares of a company that you want to acquire, it is easier to target companies that are doing poorly. Not only will they be more likely to have shares available, but they'll be more willing to approve a takeover.

When to Sell

Stock prices change based on growth. There are times in the game when the economy contracts. When sales start to fall, share prices typically follow. If you're looking to time when to exit a stock, follow the news and memos for events such as wars, recessions, and depressions.

Adjusting Dividends

Dividends are quarterly payouts to owners of your shares. You can change the dividends of the company you manage and any company you have 50% or more ownership of.

If you want to make money from your subsidiaries, you'll use the dividend system. This is the only way to extract capital from companies you own.

You will need to be careful and not increase the dividend rate too high. If you do, you will drain the company out of capital which can kill the company and cause lawsuits.

But why would you need to change the dividend rate for your own company? If your company is publically traded, your shareholder morale may drop. One of the best ways to raise shareholder morale is to pay dividends.

If you own less than 50% of the company and morale drops, shareholders may demand dividend payout automatically. And if the “Can Be Fired” setting is enabled, you risk the board firing you if their morale drops too low.

So dividends can be a tool to get your company paid and keep your shareholders happy.

Acquisition

Buying companies is a great way to expand your company and reduce competition. We cover how to use the GUI on the Financials page. This section will cover how to get acquisitions approved. And what happens after the purchase.

Buying

The first thing to consider is if you have enough funds to purchase the company. If you do not, you will not be able to purchase the company. Bonds are a great way to raise the necessary funds.

When you attempt to acquire the company, the shareholders of that company will vote if they approve. If 50% of the shares are yes votes, then the acquisition is approved. Any shares you own are automatic yes votes, which means if you own more than 50% of the company, you can automatically acquire them.

How well the company is doing determines how shareholders vote. If their company is doing poorly or they're predicting a downward trend, they're more likely to vote yes to the purchase. But if the company is healthy and doing well, they're unlikely to allow the buyout.

Denied

When you're denied a takeover, you won't be able to make another offer to any company until the next turn. If shares are available, you can still purchase them to make your next attempt more likely to be approved.

Approved

When an acquisition is approved, the amount of money you pay is distributed to shareholders. In return, you receive all assets that the company had. This includes cash funds, branches, designs, marques, shares, and factories. The game will sell or close assets such as factories located where you already have assets.

The company will become one of your marques. And the assets they owned are still assigned to them.

You may continue to use them as a marque of your company. See the marque page for more details.

Consolidation

Consolidations are another way to take over companies. But unlike an Acquisition, you're not purchasing the company. Instead, you are merging with the company to form a new company.

When you consolidate, the game creates a new company with a randomized name. Your previous company becomes a marque of the new company, and the company you're merging with becomes a marque.

You will have control of the new company, but the total number of shares will increase by the sum of both company's issued shares.

If you wish to rename your company, you can use the restructuring system.

Beyond that, consolidation works the same as an acquisition. When approved, all assets of both companies merge. The game will sell or close assets such as factories located where you already have assets.

You may continue to either brand as a marque of your company. See the marque page for more details.