Table of Contents

For information on standard reports, see the Reports page.

Video Tutorials

Dynamic Report Buttons

You can dynamically generate reports throughout the game using a chart button.

Most of these reports have basic graphs related to the subject the button is near. Here are a few examples:

But there are a few buttons that open extremely important reports. We cover them in the remaining sections of this page.

Wealth Demographic And Buyer Rating Report

The Wealth Distribution and Buyer Rating Report is one of the most important reports in the game. You can find the dynamic report button for this report next to where you enter a vehicle's sales price in the Branch Distribution system. This is in both the World Map branch system and the Mega Menu.

This button will open a Wealth Demographics And Buyer Rating Report for the selected vehicle in the selected city. It only displays the information for the selected vehicle in the selected city. You will need to generate a new report for any other vehicle or city.

Wealth Demographic Reports

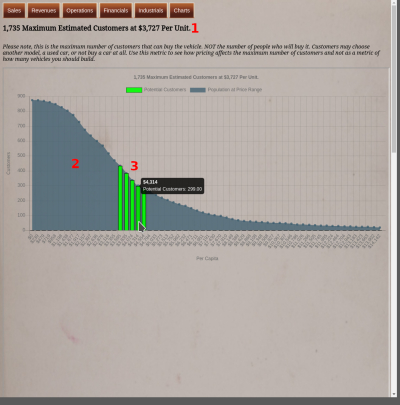

The Wealth Demographics graph is the first section of the report you'll see. This graph breaks down the people interested in buying this vehicle type, in this city, into household income buckets using the blue chart (#2). The number of people is on the Y-axis, and their income is on the X-axis. You can hover over the points to get the specific dollar and population size values.

The bright green bar graphs are the number of people interested in buying a vehicle around the price point of your selected model (#3). Your vehicle is too expensive for the dark blue area to the left of the green bars. And your vehicle is too cheap for the areas to the right of them.

The broader the appeal of your vehicle, the more bars you will have above and below the sales price. The number of bars in the graph changes based on your marketing and image ratings. The better your marketing or image ratings are, the more bars you'll have, thus more people willing to pay out of their price zone for your vehicles.

At the top of this report is the maximum potential customers at your current sales price (#1). This value is only the maximum potential and is not an estimation of your sales. The more green bars you get, the more maximum potential sales you will have.

You can access additional data by scrolling down the report.

Buyer Rating Table

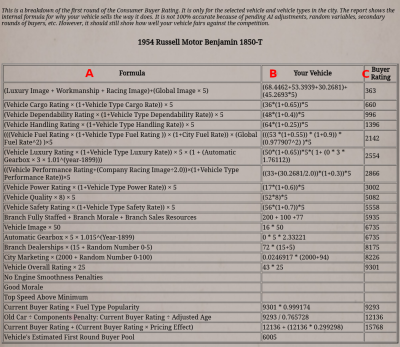

This part of the report is the Buyer Rating Table. This table is the most important tool you have to understand why a vehicle is selling the way it is.

Internally, the game formulates your vehicle offerings into a single variable called a buyer rating. It then uses this buyer rating to compare against other vehicles of the same class, target demographics, and economic demographics. It then distributes sales based on this buyer rating and a few additional details.

This table is nearly the entire buyer rating calculations used in the game. It goes through line by line and displays the numbers used to calculate your buyer rating. It also displays what the buyer rating is at that point in the calculation.

With this data, you can analyze where you are losing buyer rating points. And you can see what parts of the design are giving you more of them.

The table has three columns. Each row in the table is a section of the buyer rating formula. Column A contains the variables and arithmetic for that section of the formula. Column B shows the math for that section of the formula using your vehicle and company numbers. Finally, Column C shows the sum of that row's value and the previous row's buyer rating. Meaning, that Column C of each row is the buyer rating at that point in the buyer rating calculations.

| Formula | Variables | Max Points |

|---|---|---|

| (Luxury Image + Workmanship + Racing) + (Global Image × 5) |

These images ratings are visible in the Prestige and Image reports. | 800 |

| (Vehicle Cargo Rating × (1 + Vehicle Type Cargo Rating)) × 5 |

| 500-1000 |

| (Vehicle Dependability Rating × (1+Vehicle Type Dependability Rate)) × 5 |

| 500-1000 |

| (Vehicle Handling Rating × (1+Vehicle Type Handling Rate)) × 5 |

| 500-1000 |

| (((Vehicle Fuel Rating × (1 + Vehicle Type Fuel Rating)) × (1 + City Fuel Rate)) × (Global Fuel Rate^2))×5 |

| Depends on City And Global Fuel Rate |

| (Vehicle Luxury Rating × (1+Vehicle Type Luxury Rate)) × 5 × (1 + (Automatic Gearbox × 3 × 1.01^(year-1899))) |

| 1900: 2015-4030 2020: 5500-11000 |

| ((Vehicle Performance Rating+(Company Racing Image÷2.0))×(1+Vehicle Type Performance Rate))×5 |

| 750-1500 |

| (Vehicle Power Rating × (1+Vehicle Type Power Rate)) × 5 |

| 500-1000 |

| (Vehicle Quality × 8) × 5 |

| 4000 |

| (Vehicle Safety Rating × (1+Vehicle Type Safety Rate)) × 5 |

| 500-1000 |

| Branch Fully Staffed + Branch Morale + Branch Sales Resources |

| 400 |

| Vehicle Image × 50 |

| 5000 |

| Automatic Gearbox × 5 × 1.015^(Year-1899) |

| 1900: 5 2020: 30 |

| Branch Dealerships × (15 + Random Number 0-5) |

| No Max |

| City Marketing × (2000 + Random Number 0-100) |

| 5343 |

| Vehicle Overall Rating × 25 |

| 2500 |

Low Engine Smoothness |

| -97% |

| No Engine Smoothness Penalties |

| |

Low Morale: |

| -100% |

| Good Morale | Branch morale is good, no penalties. | |

Top Speed Too Slow Vehicle Top Speed ÷ Minimum Top Speed For Vehicle Type |

| -100% |

| Top Speed Above Minimum | The vehicle is fast enough to meet the minimum requirements, so no penalty. | |

| Current Buyer Rating × Fuel Type Popularity |

| ≐ -100% |

| Low Slider Penalty: Current Buyer Rating × Penalty |

| -42% |

Old Car & Components Penalty: Current Buyer Rating ÷ Adjusted Age | This is a penalty for using old designs or selling an old vehicle design.

| ≐ -100% to +23.5% |

| Current Buyer Rating + (Current Buyer Rating × Pricing Effect) |

| |

| Price Gouging Penalty |

| ≐ -100% |

| Quality to Price Ratio Penalty |

| ≐ -100% |

| Neuron Processing Penalty (Hard or Nightmare Difficulty): Current Buyer Rating × 0.95 | The game applies this penalty if you are a human and are playing on Hard or Nightmare mode. Sorry, the AI needs this sort of crutch. | -5% |

| Vehicle's Estimated First Round Buyer Pool | This value is the maximum number of customers interested in purchasing this vehicle after processing the buyer rating. It is not, however, the number of people purchasing the vehicle. That is in the next table. |

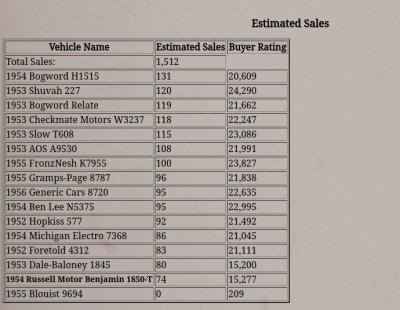

Sales Table

Finally, the report will generate the estimated sales figures in the city for all vehicles of this type. The table displays the name of the vehicle, the estimated sales, and the final buyer rating. And it is ordered by the estimated sales. You'll notice that table isn't ordered by buyer rating, but models with higher buyer ratings tend to sell more vehicles than ones with lower buyer ratings. Remember, variables such as the number of dealerships, the amount of marketing, and company image can change the size of the buyer pools of individual models.

Stock Report

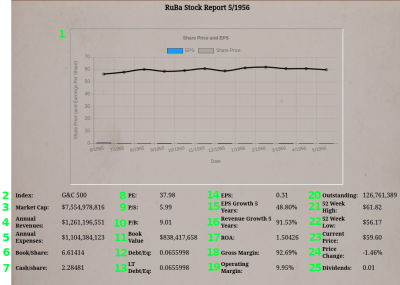

The Stock Report contains additional information about a selected stock. The game generates a Stock Report dynamically, and you can only access it via the Dynamic Report Button located in the Stock Broker window. You can find this button next to the Public Companies header just above the company selection drop-down box.

Report Data

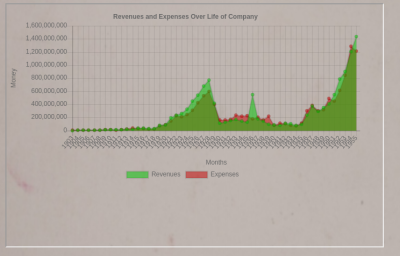

The Stock Report contains two charts, a bunch of financial data, and three tables. The first section contains financial data.

- The top of the report is the financial stock chart. It is a historical graph with the share price of the company and the quarterly earnings per share. The Y-axis contains share prices. You can hover over the Blue EPS bars to see the EPS on the graph.

- The Index is fluff information. All companies in the game are in the Gear & City 500 index.

- Market Cap is the value of the company. This value comes from multiplying the Outstanding Shares by the Current Share Price.

- Annual Revenues is revenues over the last 12 months.

- Annual Expenses is expenses over the last 12 months.

- Book/Share is the book value of the company, divided by the Outstanding Shares. These numbers are the actual unspeculative value of the company per share. For example, if the book value is $12 and the share price is $15, the actual value of the company is $12. The extra $3 in share price is how much others are willing to speculate that the company will grow in value.

- Cash/Share is how much cash the company has per share. For example, if this value is $8, then the company has $8 in cash for every share.

- PE stands for Price to Earnings. This value divides the Current Share price by the annual Earnings Per Share (EPS). If the EPS is negative, the PE is 0. This metric is a good way to determine if a stock is over or underpriced. You can consider 20 fairly priced.

- P/S is Price to Sales. This value takes the share price of the company and divides it by the Annual Revenues per share (Annual Revenues divided by Outstanding Shares). A low ratio can indicate that the market undervalues this stock, and with a high ratio, they overvalue it.

- P/B stands for Price to Book. This value divides the current share price by the Book/Share value. You would use P/B for a metric of how over or underpriced a stock is. The lower the ratio, the better value the stock is.

- Book Value is the value of all the assets the company owns. It is the value of the company if they were to liquidate.

- Debt/Eq stands for Debt to Equity. This variable divides your short-term debt, the debt from loans and revolving credit, by the total amount of assets your company has. The higher this ratio is, the more debt load this company has.

- Long Term Debt to Equity is the same as Debt/Eq, except the debt is long term. In the game, this is Bonds. Bonds are less of a cause of concern in the game because companies will roll old debt into new bonds when they expire. The higher this value is, the more debt the company has, which can slow company expansion.

- EPS, or Earnings Per Share, are revenues minus expenses, divided by the total number of shares. Or in more layman terms, profits or losses are divided by the number of shares. This metric is one of the most important corporate fundamentals to watch. Profitable companies will have EPS’s above zero, and unprofitable ones are under zero.

- EPS Growth 5 Years shows the EPS growth over the last five years. This value compares the Annual EPS from five years ago against the sum of the previous four EPSs.

- Revenue Growth 5 Years is the same as the EPS Growth 5 years, except it is for revenues instead of EPS.

- ROA stands for return on assets. The ROA comes from dividing the company revenues by the total amount of assets. This value is a metric for how much money a company generates based on the number of assets they have. A higher ROA means the company needs fewer investments to make more income. And a lower ROA shows that the company has to tie up most of its funding in assets to generate revenues.

- Gross Margin is the revenues minus the cost of goods (not including indirect fixed costs such as administration costs) divided by revenues. We display this value as a percentage. The higher it is, the more money the company is making in relation to the cost of their goods.

- Operating Margin is the profits a company makes for every dollar of revenue. We determine the value by dividing the profits by revenues. Unlike gross margins, this value includes all fixed costs. A higher percentage means the company is making more profits off of their sales. Whereas a low value means the company spends most of its revenues, and a negative value means the company is losing money on each sale.

- Outstanding is the total number of shares available for trading. A share is fractional ownership of the company. If you own all the shares, you own 100% of the company. If you own 10% of the shares, you own 10% of the company.

- 52-Week High is the highest the share price has been at over the last year.

- 52 Week Low is the lowest the share price has been at over the last year.

- Current Price is the current price of a single share. Shares change prices based on how much other people will pay for them. You can use the other metrics on this page, such as Book/Share or PE, to determine if the current share price is a fair value for this stock.

- Price Change is the percentage of change to the share price since last month.

- Dividends are payments to shareholders for each share they own of the company. They pay this payment out every quarter, and it can be a great source of revenue.

Factory And Branch Table

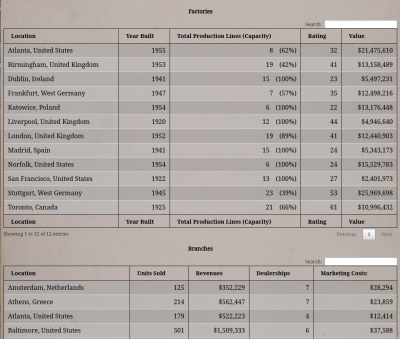

The top table is the Factory table. It displays all the company's factories, the year they built the factories, production line capacity, overall rating, and the value.

Below that is the Branch table. Like the Factory table, it displays all the company's branches, how many vehicles they sold, revenues, dealership count, and marketing expenses.

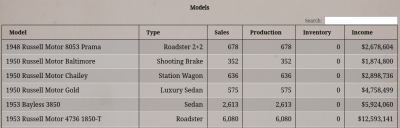

Model Table

The third table is the Model Table. This table lists all active vehicle models, their type, sales, inventory, and revenues.